mississippi income tax rate 2021

Proposed Individual Income Tax Phaseout. Mississippi Single Income Tax Brackets.

Historical Mississippi Tax Policy Information Ballotpedia

The graduated income tax rate is.

. Mississippi Tax Rate Information. The tax brackets are the same regardless of your filing status and tax rates range from 0 to 5. Combined Filers - Filing and Payment Procedures.

Tax Year 2018 First 1000 0 and the next 4000 3 Tax Year 2019 First 2000 0 and the next 3000 3 Tax Year 2020 First 3000 0 and the next 2000 3 Tax Year 2021 First 4000 0 and the. Mississippi sales tax rates. All these rates apply to incomes over 2 million with the highest rate of 1090 applying to incomes over 25 million.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. Form 80-105 is the general individual income tax form for Mississippi residents. There is no tax schedule for Mississippi income taxes.

A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate. Eligible Charitable Organizations Information. The state income tax system in Mississippi is a progressive tax system.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Mississippi residents have to pay a sales tax on goods and services. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

For 2022 the first 5000 of income tax is not taxed. For 2022 tax year. Find your pretax deductions including 401K flexible account contributions.

The previous 882 rate was increased to three graduated rates of 965 103 and 109. For tax year 2021 the first 4000 of earned income would not be taxed and the next 1000 is taxable at a rate of 3. According to the bill the legislature will take a second look at the tax rates in 2026 and decide if there.

Details on how to only prepare and print a Mississippi 2021 Tax Return. Corporate Income Tax Division. Those rates are significantly above the statewide average tax rate of 84 and the average rate paid by white households of 82.

Because the income threshold for the top bracket is quite low. Medical marijuana and taxes the hallmark 2021 legislative efforts are likely dead. Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return.

Mississippi Income Tax Calculator 2021. Mississippi State Income Tax Forms for Tax Year 2021 Jan. Under current law in arriving at Mississippi taxable income a personal exemption of 6000 single filers 12000 joint filers or 9500 head of family filers is allowed.

Ad Compare Your 2022 Tax Bracket vs. Mailing Address Information. House tries to revive it.

How to Calculate 2021 Mississippi State Income Tax by Using State Income Tax Table. Mississippis SUI rates range from 0 to 54. Form 80-100 - Individual Income Tax Instructions.

Find your income exemptions. Senate kills Mississippi income tax elimination. Check the 2021 Mississippi state tax rate and the rules to calculate state income tax.

3 on the next 3000 of taxable income. Corporate and Partnership Income Tax Help. Starting in 2022 only the 4 percent and 5 percent rates will remain with the first 5000 of income exempt from taxation up from 3000.

Beginning with tax year 2018 the 3 income tax rate will be phased out over a five-year period. Mississippi Income Tax Calculator 2021. Discover Helpful Information And Resources On Taxes From AARP.

Income tax is a tax that is imposed on people and businesses based on. A dependent exemption generally 1500 per dependent is also allowed. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

The taxable wage base in 2022 is 14000 for each employee. If you make 140000 a year living in the region of Mississippi USA you will be taxed 31194. In tax year 2021 only 1000 in marginal income will be subject to the 3 percent rate with the other 1000 exempt.

You must file online or through the mail yearly by April 17. Mississippis 3 Percent Income Tax Rate Will Phase Out by 2022. Income ranging between 5000 to 10000 would be taxed at 5.

Integrate Vertex seamlessly to the systems you already use. These back taxes forms can not longer be e-Filed. You may file your Form 80-105 with paper.

The tax rate reduction is as follows. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Hurricane Katrina Information.

Mississippi has a graduated tax rate. In addition taxpayers may claim itemized deductions. Below are forms for prior Tax Years starting with 2020.

Mississippi Income Tax Forms. Your 2021 Tax Bracket To See Whats Been Adjusted. And the Institute of Taxation and Economic Policy argue both Reeves and Gunns plans would further escalate the tax burden on Mississippis low income families while giving the wealthy a tax break.

Outlook for the 2023 Mississippi income tax rate is to remain unchanged. By Bobby Harrison March 22 2021. By Geoff Pender March 16 2021.

If youre married filing taxes jointly theres a tax rate of 3 from 4000 to 5000. Phaseout of the 3 tax bracket is now complete. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

Find your gross income. Detailed Mississippi state income tax rates and brackets are available on this page. Income Tax Bracket Tax Rate 2022.

The current tax year for individuals is 2021 with taxes due April 18 2022. Your average tax rate is. 4 on the next 5000 of taxable income.

5 on all taxable income over 10000. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000.

In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget. Ad Calculate your federal income tax bill in a few steps. 0 on the first 2000 of taxable income.

Your average tax rate is. These rates are the same for individuals and businesses. Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Mississippi Income Tax Calculator Smartasset

Tax Rates Exemptions Deductions Dor

Your Guide To Mississippi S Tax Free Weekend 2022

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

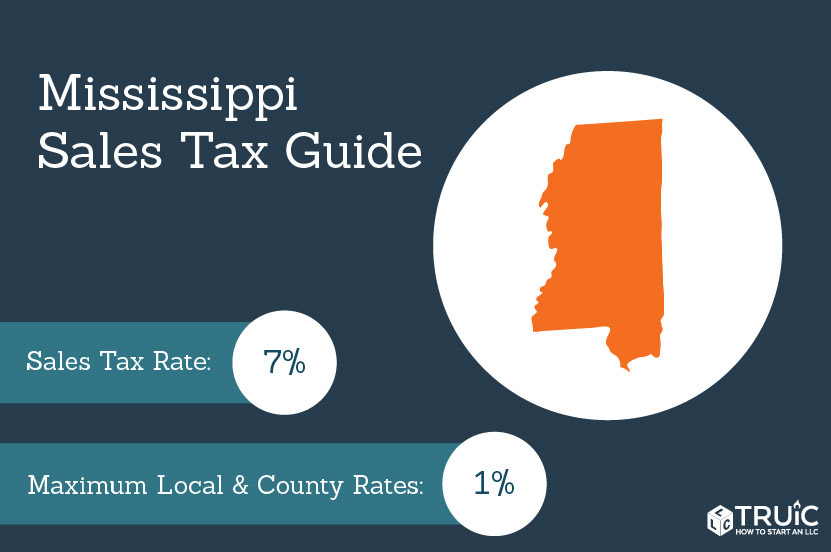

Mississippi Sales Tax Small Business Guide Truic

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Eliminating The State Income Tax Would Wreak Havoc On Mississippi Itep

Commentary Mississippi Should Invest In Its People Not Chase The False Promise Of Tax Competitiveness Center On Budget And Policy Priorities

Mississippi Tax Cuts Battle 5 Things To Know

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Filing Mississippi State Tax Returns Things To Know Credit Karma